The fuel to combat global climate change: All About Biogas Series, Article #1

February 7, 2022 Biogas

By Rob Stein, Skyline Energy

Hopes of a “green recovery” to pull the global economy out of its current pandemic-induced slump are on the minds of many governments around the world. In fact, the Organisation for Economic Co-operation and Development (OECD) now hosts a Green Recovery database that outlines hundreds of “environmentally positive recovery measures” being taken by governments, representing public investments of over 670 billion USD.1 Canada’s own 2021 Budget, which supports a range of climate and conservation technologies and jobs, is talked about in similar terms; even the Prime Minister’s Facebook page refers to a “green recovery to create good jobs and a cleaner future”.2

One of the most promising green technologies that can help the world emerge from the crisis is biogas. Biogas is generated through the decomposition of organic matter in the absence of oxygen, a process known as anaerobic digestion. Biogas can be used to generate electricity and heat, and when refined, can even substitute for natural gas in our homes and vehicles; it also provides an important way of managing many kinds of organic waste. This clean energy source is not currently as established as solar and wind power – at least in North America – but this in itself offers a real opportunity to expand the biogas sector, creating green jobs and enabling growth in an environmentally responsible industry.

In this article, the first in a series of three articles around biogas, we will look at the global and domestic regulatory and economic environment in which biogas is being deployed. We will discuss the state of the industry, including regulatory and economic factors that impact growth in the sector. Subsequent articles will go into more detail around the technology itself, and examine how environmental considerations, especially around climate change, are impacted by different biogas plant designs and the end use of its products. This series aims to provide readers with a solid introduction to the economic and environmental context in which this promising technology is being deployed.

Biogas in a nutshell: how does it work?

Biogas is a gas mixture derived from the breakdown of organic matter, such as food and animal wastes, in an oxygen-deprived (or anaerobic) environment. Biogas typically contains 50-60% methane, with the remainder being mostly carbon dioxide.

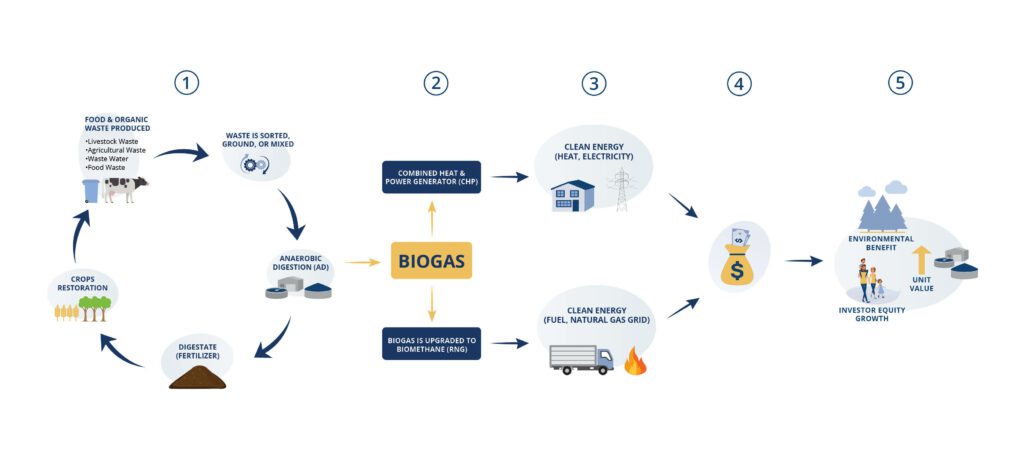

- Food and organic waste is produced. The waste is sorted, ground, or mixed.

- The waste enters a biodigester and begins the process of anaerobic digestion, which creates biogas, and the by-product of digestate (fertilizer).

- The biogas runs through a Combined Heat & Power generator and is used for heat and electricity (or it is upgraded to Renewable Natural Gas and used for fuel).

- The provincial government, or the private business/landowner, pays a fixed rate per kWh of electricity produced from biogas.

- Biogas produces a cash flow to be re-invested in acquiring new assets and optimizing current assets. This creates a compounding effect for the fund’s unit value. The growth of the fund benefits both investors and the environment.

Who’s making biogas?

Biogas is widely used as a fuel around the world. In many European countries, industrial farms house large, state-of-the-art facilities that pump out many megawatts (MW) of electric power and heat for modern industry and homes. Denmark’s largest plant, Lemvig, produces enough electricity for 22,000 people and heat for another 3000 homes.3 In rural villages in Asia and Africa, biogas is often made in small clay brick digesters to provide a low-tech source of cooking gas and heat. In between these extremes are thousands of farm-scale, industrial, and municipal digesters that generate biogas, heat and electricity while helping in the management of a wide range of organic wastes.

Biogas and natural gas: what’s the difference?

What happens in the formation of methane in a biogas system is not unlike what has happened over millions of years in the creation of the natural gas we extract from under the ground – the gas that heats half the homes in Canada4 and generates over 9% of the nation’s electricity.5 But when it comes to biogas, we are not talking about extracting millions of years of sunlight energy from the Earth; the scale is more like years, or even months. This is a key difference between biogas and natural gas: because the carbon in biogas was only recently removed from the atmosphere – and on a scale that can be replenished every year – it is generally viewed as a renewable, carbon-neutral fuel.

The scale of Biogas Facilities in Canada

The Canadian 2020 Biogas Market Report, published by the Canadian Biogas Association (CBA),6 shows that the number of biogas projects in Canada more than doubled between 2011 and 2020, and there are now more than 270 biogas facilities operating across the country.

- 126 of the sites are municipal and manufacturing wastewater treatment facilities handling liquid wastes

- Municipal landfills represent 99 of the sites; at these landfills, methane (landfill gas, or LFG) is captured by a series of wells and pipes that penetrate through rotting garbage.

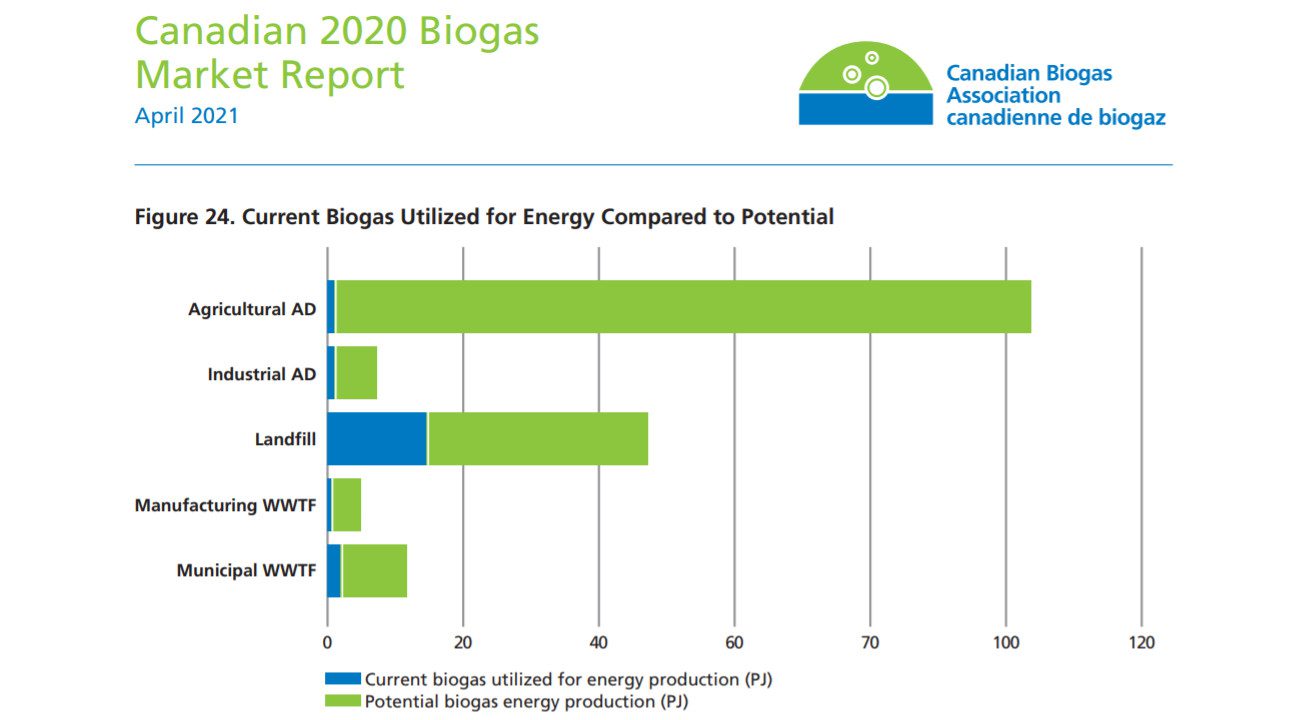

- 45 sites are “on-farm” digesters that help deal with animal and crop residues while providing additional income streams. It is this sector that offers the most opportunity for expansion (see figure).

- The remaining nine sites are industrial, large-scale digesters that handle, among other things, a lot of our municipal sorted waste (green bins).

Why “on-farm” biogas digesters are important

The Canadian Biogas Association reports that only 13% of Canada’s “easy” biogas potential is currently being utilized; the agricultural sector could see a large increase in employment opportunities for both skilled and unskilled workersas a growing sector for net-zero carbon investment continues.

The value of on-farm biogas digesters comes from a number of activities.

- First, the disposal of waste provides a service to the farmer – especially in treating manure – as well as outside feedstock suppliers, who would otherwise be faced with landfill disposal (“tipping”) fees. So simply obtaining the raw materials can be profitable.

- Second, there is the value of the energy being produced from biogas; this can be electricity sold to the grid or used locally, or it can be in the form of renewable natural gas (RNG), a purified form of biogas. A biogas genset can be run constantly to provide steady baseload electric power; the gas can also be stored for short periods, allowing operators to sell power at optimum or peak periods.

- There is also the value of the “waste” heat, which can provide heat for buildings, water, or industrial processes. A CHP system can enable up to 80% of the energy to be utilized.7

- Finally, the end product of the process is a rich organic digestate that can be used to improve soils or as bedding for farm animals.

Why aren’t there more biogas facilities in Canada?

Given the benefits of biogas, it is fair to ask why we are not using more of it in Canada. Indeed, we can compare Canada’s few hundred facilities with Germany, where supportive renewable energy policies have spurred to the deployment of some 9,600 digesters, most of which are on-farm. Dozens of these facilities are associated with “bioenergy villages,” entire communities that receive heat and a largely passive local income stream.8

As the German experience suggests, policy and regulations are a key factor, and they can be either enabling or restrictive. Among enabling policies, perhaps the most important are those that enable the high-value products of biogas – especially electricity, heat, or RNG – to reach a market.

In terms of electricity, the ability to reach a market essentially means the ability to connect to the grid, so that biogas facilities can sell the electricity they generate and capture this core value stream. Ontario’s Feed-in-Tariff (FIT) program, which was in part modelled after the German experience, sought to encourage biogas investment with payments initially starting at 16.4 cents per kilowatt hour (kWh), and as much as 26.5 cents per kWh for smaller facilities. Yet after seven years and five rounds of the FIT program, the Province’s Independent Electricity System Operator (IESO) reports only 24 on-farm biogas facilities online in Ontario, together amounting to only 5.5 MW of generation capacity. By comparison, the same program led to the construction of more than three thousand solar projects, with a combined capacity of almost 1500 MW.9

The reasons for the low adoption rate are many:

- Insiders observed a low level of familiarity with the technology and a relative shortage of equipment and service providers (compared to solar or wind).

- Biogas projects tend toward a larger scale and take a long time to see through, and, under the FIT program, required a costly Renewable Energy Assessment (REA) for the Ministry of the Environment.

- Unlike solar, biogas installations have substantial ongoing labour costs, as facilities typically need to be monitored and adjusted carefully to optimize output.

These factors have made biogas less immediately attractive than solar, and the tepid response to the FIT program suggests that the pricing, though secure, was not sufficient to offset the challenges of entry. Meanwhile, FIT programs for biogas have not been adopted in other provinces, and market rates for electricity are often too low to support development, while the additional benefits of biogas can be difficult to monetize. Despite this, and thanks to some additional supports to be discussed below, the number of digesters deployed – especially in Ontario, Alberta, Quebec, and British Columbia – continues to grow.

For facilities that can upgrade their biogas to biomethane (renewable natural gas, or RNG), enabling policies would need to allow them to connect to the natural gas grid. For example FortisBC, British Columbia’s major natural gas supplier, has negotiated contracts with the BC government allowing it to take improved biogas from a number of digesters for injection into its distribution grid.

Finally, in terms of heat produced from biogas, enabling policies would allow the low-level heat to be used by a nearby facility such as a factory, laundry, or greenhouse. Interestingly, most biogas produced in China is used for heating, while most in Europe goes toward producing electricity. In Canada, the end-use is split among electricity (29%), RNG (16%), and direct heating (14%); the remainder (41%) is flared off, offering no additional benefit except in destroying the methane, which is a very powerful greenhouse gas.10

Provincial policies bringing more potential for biogas adoption

In a few jurisdictions, policy is tending toward allowing companies to include RNG on a voluntary basis. For example, FortisBC started with RNG on a pilot basis in 2010, and now aims to have 15% of its supply renewable by 2030, which could accelerate a move beyond the province’s current allowance (under its Greenhouse Gas Reduction Regulation) of only 5% RNG on the natural gas system. Additionally, Ontario’s 2018 Made-in-Ontario Environment Plan (MOEP) encouraged the use of renewable fuels and indicated the government’s intent to require natural gas utilities to implement “a voluntary renewable natural gas option for customers.” The distributor Enbridge is now building a major RNG facility in Niagara, and in late 2020 the Ontario Energy Board approved its RNG pilot program. Starting in April 2021, Enbridge’s “Opt up” program allows customers to support RNG with a $2-per-month line item on their bill.

Quebec has gone further with its 2019 Regulation, which requires a natural gas distributor to deliver an annual RNG minimum of 1% of the total gas volume distributed in 2020-2021, increasing to 5% by 2025-2026. Along with market demand, this policy has prompted the distributor Énergir to move to increase the RNG portion in its distribution network to 10% by 2030.11

Another boost to biogas could come from policies like Ontario’s new Food and Organic Waste Framework, which aims to reduce the amount of organics heading to municipal landfills. While Ontario municipalities have made great strides through segregated waste collection (green bins), studies show that only about half of residential organic waste, and only about a quarter of industrial commercial and institutional (ICI) waste, is diverted for composting. The rest, some 2.3 million tonnes annually, generally heads to a landfill.12 This policy aims to eliminate food and organic waste going to landfill, and targets zero GHGs from the waste sector. Ontario is also reducing red tape around small and mid-sized CHP systems, which could support the marketing of excess heat from smaller biogas systems, further supporting green jobs and investment while improving energy economics in the province.

Further biogas support from federal policies

This network of provincial policies is supported by some encouraging moves from the Federal government. Canada’s 2021 budget, optimistically called a “recovery” budget, sets aside $1.5 billion for a Clean Fuel Fund aimed at accelerating production and adoption of renewable fuels like biogas and RNG. The budget also earmarks $165 million to revive the Agricultural Clean Technology program, which should help drive biogas opportunities on farms.13 Canada has also pledged to cut its greenhouse gas emissions to net-zero by 2050, and announced a carbon tax equivalent to $170/tonne, which could be a major boost to low-carbon fuels. Unfortunately for the sector, the proposed federal clean fuel regulation (CFR), a complement to the Greenhouse Gas Pollution Pricing Act, was recently amended to refer only to liquid fuels like gasoline and diesel, so in its current form it is unlikely to do much to boost biogas.14

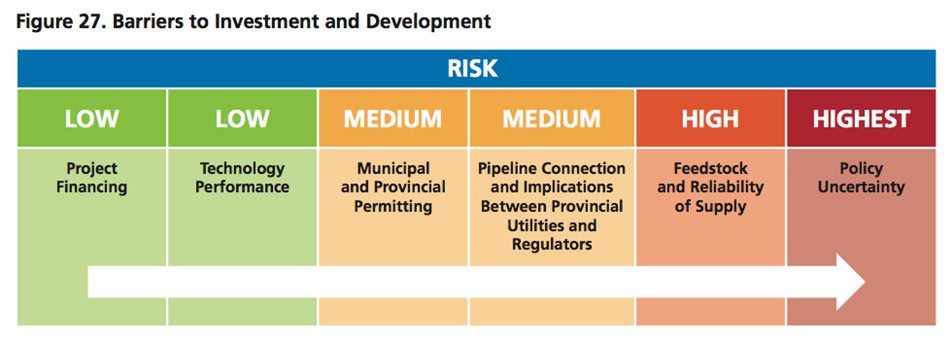

While these policies seem poised to spur at least some growth in the biogas sector, its wider uptake still face a number of challenges (see figure). The most serious are policy uncertainty, risks around feedstock supply chains, and regulations that make connecting to the grid difficult. Many players have found ways to reduce their risks by securing long term contracts for feedstock supply and solid power-purchase agreements, and the industry as a whole can benefit from showcasing the success of these existing projects. Industry leaders must also work with provincial and municipal governments to ensure policy commitments are supported with the necessary technical measures (like facilitating grid connections).

Why does biogas matter to the everyday person?

The expansion of biogas in Canada will of course bring value to operators and investors, but the benefits reach much further than that:

- Growth in biogas means Canadians, and the world, will enjoy the climate benefits of lower GHG emissions, while helping governments achieve climate-related targets. (We will look more closely at these impacts in subsequent articles in this series.)

- Municipalities, too, will find some relief as pressure on municipal landfills is reduced.

- Rural residents will experience fewer odours from fields when the manure has been pre-digested, and the impacts of this natural fertilizer on water and wildlife will be reduced as well.

- “Free” heat could improve the economics of greenhouses and extend the growing season, contributing positively to local food security.

- Replacing natural gas also conserves in-ground fossil gas for future generations.

- The benefits of biogas can even contribute to the achievement of a number of the United Nations’ Sustainable Development Goals.15

These benefits will be realized if supportive policies come into place, and investors and industry players can have confidence in their durability. For now, the policy environment is promising, yet Canada is still utilizing only a fraction of its biogas potential. Climate and economic incentives will point the way toward a green recovery in Canada, and will require ongoing coordination among federal, provincial and even municipal governments, along with regulators in the electricity and gas sectors. The right policy changes will allow us to tap the full potential of biogas even further, instead of continuing to tap our fossil fuel resources.

Rob Stein

President, Skyline Energy

Rob is responsible for the operational and financial performance of Skyline Clean Energy Fund’s clean energy asset portfolio, including overseeing acquisitions, dispositions, financial budgets, implementing and monitoring capital expenditure projects, and monitoring the assets’ functionality. With extensive experience in evaluating, building, maintaining, and selling renewable energy assets, his well-rounded knowledge of the solar energy industry is an invaluable asset to the Skyline Energy team.

Skyline Energy manages clean energy assets for Skyline Clean Energy Fund, a sustainable investment offered as a private alternative investment product by Skyline Wealth Management.

References

- https://www.oecd.org/coronavirus/en/themes/green-recovery

- https://www.facebook.com/JustinPJTrudeau/videos/485747972867644/

- https://www.trackmyelectricity.com/plants/lemvigbiogasdenmark

- https://www.nrcan.gc.ca/energy/sources/natural-gas/17894

- https://www.nrcan.gc.ca/science-data/data-analysis/energy-data-analysis/energy-facts/electricity-facts/20068

- The full report is available to members of the Association, and the summary report can be requested. The key data are also summarized at https://mcusercontent.com/881b9099f1cf2d8e98772c098/files/713e79d0-07a3-89a5-cce2-1d96d623f53d/Canadian_2020_Biogas_Market_Full_Report.pdf

- https://dnr.mo.gov/document-search/combined-heat-power-chp-pub2963/pub2963

- Appune, Kerstine, 2016. “Bioenergy – the troubled pillar of the Energiewende.” Clean Energy Wire, September 30. Online at https://www.cleanenergywire.org/dossiers/bioenergy-germany

- IESO, A Progress Report on Contracted Electricity Supply , June 2021, pp. 12, 34. Online at https://ieso.ca/-/media/Files/IESO/Document-Library/contracted-electricity-supply/progress-report-on-contracted-electricity-supply.ashx

- Canadian Biogas Association, Canadian 2020 Biogas Market Report – Summary, April 2021, p. 15. https://mcusercontent.com/881b9099f1cf2d8e98772c098/files/713e79d0-07a3-89a5-cce2-1d96d623f53d/Canadian_2020_Biogas_Market_Full_Report.pdf

- Bundock, Emilie, Christopher Bystrom and Jean-Philippe Therriault, 2021. Energy In Transition: Renewable Natural Gas Has A Role To Play. Energy Bulletin, 07 May 2021. Online at https://www.fasken.com/en/knowledge/2021/05/3-energy-in-transition-renewable-natural-gas

- https://www.ontario.ca/page/food-and-organic-waste-framework

- “Budget 2021 Boosts the Role of Biogas in Canada’s Economic Recovery”, CBA Press release, April 30 2021. Online at https://biogasassociation.ca/index.php/news_and_events/entry/budget_2021_boosts_the_role_of_biogas_in_canadas_economic_recovery

- Bundock, Emilie, Christopher Bystrom and Jean-Philippe Therriault, 2021. “Energy In Transition: Renewable Natural Gas Has A Role To Play.” Energy Bulletin, 07 May 2021. Online at https://www.fasken.com/en/knowledge/2021/05/3-energy-in-transition-renewable-natural-gas

- World Biogas Association, “The Contribution of Anaerobic Digestion and Biogas towards achieving the UN Sustainable Development Goals.” Online at https://www.worldbiogasassociation.org/the-contribution-of-anaerobic-digestion-and-biogas-towards-achieving-the-un-sustainable-development-goals-2016/

About Skyline Clean Energy Fund

Skyline Clean Energy Fund (“SCEF”) is a privately owned and managed portfolio of medium to large scale clean energy assets, focused on acquiring income-producing assets across Canada, under long-term government contracts.

SCEF is offered as an alternative investment product through Skyline Wealth Management Inc. (“Skyline Wealth Management”), the exclusive Exempt Market Dealer (EMD) for SCEF.

SCEF is committed to surfacing value to its investors through asset monitoring and optimization, while providing a sustainable investment product based in clean, renewable energy.

To learn more about SCEF and its asset manager, Skyline Energy, please visit SkylineEnergy.ca.

To learn about additional alternative investment products offered through Skyline Wealth Management, please visit SkylineWealth.ca.

Skyline Clean Energy Fund is operated and managed by Skyline Group of Companies.

For media inquiries, please contact:

Cindy BeverlyVice President, Marketing & Communications

Skyline Group of Companies

5 Douglas Street, Suite 301

Guelph, Ontario N1H 2S8

cbeverly@skylinegrp.ca

More from this category:

A potential game-changer in emissions reduction: All About Biogas Series, Article #3

The first two articles in this series explored the market and regulations around biogas in Canada, and provided an overview of biogas technology. In this article we’ll look more closely at the environmental benefits of biogas from both a local and a global perspective, as well as how we can reduce some of the environmental [...]

The history and technology of biogas: All About Biogas, Article #2

In the first article in this series, we looked at the biogas industry and the regulatory environment in a number of Canada’s provinces. We will now look more closely at biogas technologies themselves, to better understand the promise and the limitations of biogas and its use in generating electricity, heat, and renewable natural gas (RNG). [...]