Our Clean Energy Fund

Investor capital, green energy initiatives, and historically reliable returns. One growth-oriented equity investment.

Invest in a sustainable, clean energy product that focuses on great investor returns, and a brighter future for all.

Invest in a sustainable, clean energy product that focuses on great investor returns, and a brighter future for all.

About The Fund

The Skyline Clean Energy Fund (SCEF) is a privately managed investment fund, focused on investing in renewable and clean energy production.

The fund generates revenue through producing clean, sustainable power via clean energy assets, such as large-scale solar fields. The power is purchased by the provincial government; this purchase agreement is backed by long-term government contracts.

The fund retains the cash flow and re-invests it into the acquisition of new income-producing clean energy assets, and the optimization of current assets.

As an alternative investment, the Skyline Clean Energy Fund is shielded from the pricing volatility of the public markets. It is Registered account (RRSP, RRIF, TFSA) eligible.

The Skyline Clean Energy Fund is available to Accredited Investors and Eligible Investors.

Fund Profitability & Growth Strategy

We serve the Skyline Clean Energy Fund by seeking and acquiring high-quality clean energy assets and businesses with sustainable, long-term cash flows. We also surface value through constantly monitoring the performance of the systems, and performing optimization and upgrade procedures.

Equity Growth

Cash flow is re-invested into the acquisition and maintenance of the clean energy assets.

Registered Account Eligible

You can invest in the Skyline Clean Energy Fund through your RRSP, RRIF, TFSA, etc.

100% Canadian

The Skyline Clean Energy Fund is comprised of clean energy assets based in Canada.

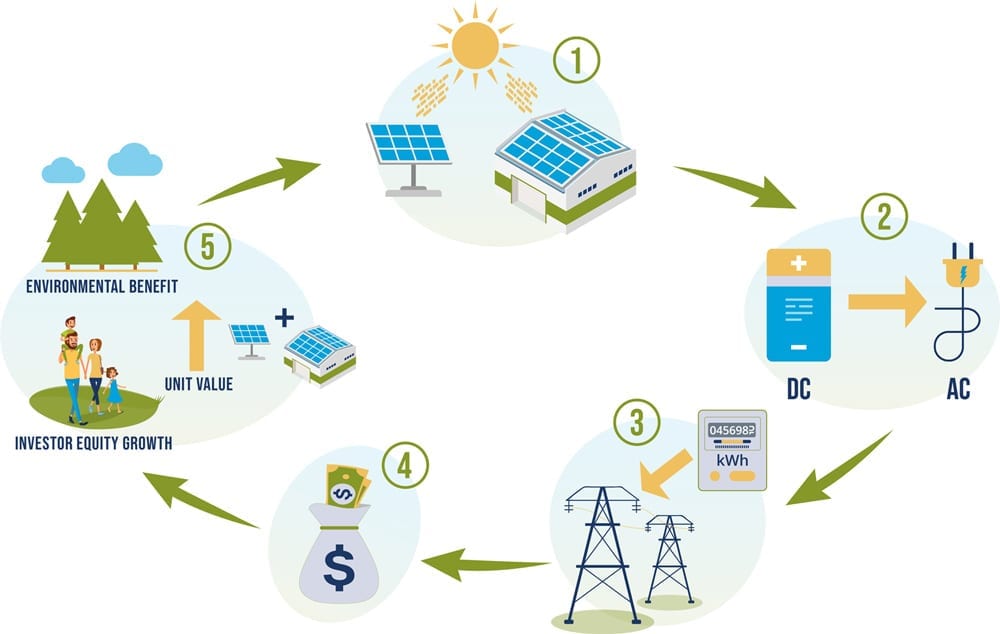

How the Skyline Clean Energy Fund Works

- Solar assets harness the power of the sun.

- The power is converted so that it can be sent to the grid for general use.

- An electrical meter captures the amount of electricity generated.

- The provincial government, or the private business/landowner, pays a fixed rate per kilowatt-hour (kWh) produced.

- Cash flow is re-invested in acquiring new assets and optimizing current assets. This creates a compounding effect for the fund’s unit value. The growth of the fund benefits both investors and the environment.

Value & Risk Mitigation

We seek income-producing clean energy assets that are backed by long-term government contracts. Owners of the contracts include First Nations groups, co-ops, municipalities, and pension funds; therefore, it is highly unlikely for the government to prematurely cancel them.

At the end of the contracts, we will facilitate negotiation of energy production for the communities that already rely on it through our energy systems.

We will also aim to supply nearby residential, commercial, or retail properties owned by Skyline with off-grid energy, as well as selling excess energy back to the grid at wholesale rates.

Get In Touch Today

Let’s Have a Conversation.

We’re in the business of helping investors realize great returns, while making a positive global impact. Together, we can make the future brighter.

Get In Touch Today

We’re in the business of helping investors realize great returns, while making a positive global impact. Together, we can make the future brighter.