How solar is operated and maintained: learn from the experts

June 1, 2021 Insights, Solar Energy

With Environmental, Social, and Governance (ESG) investments in Canada increasing in popularity, and sustainable investment funds increasing in number, investors are being offered more options to put their funds toward assets that produce clean and renewable energy, including solar photovoltaic (PV) systems.

As with any investment into a portfolio of hard assets—whether renewable energy systems, or more traditional assets such as real estate—investors must do their due diligence to understand the role of effective operations and maintenance (O&M) in generating investment growth.

Matt Kennedy, Associate Director, Skyline Energy, and Dave Raney, Manager of Solar Assets, Anvil Crawler Development Corp., have years of experience in operating, managing, monitoring, and optimizing solar assets.

While Kennedy leads the facilitation of all business operations for Skyline Energy, which manages a sustainable investment fund comprised of 65 solar assets as at May 2021, Raney is responsible for leading the solar asset operations and maintenance work for Anvil Crawler, whose team is assigned maintenance and optimization for the assets within the fund.

Kennedy and Raney both provided their insights and best practices in Canadian solar operations and maintenance.

What are some of the ways O&M maximizes the efficiency of solar assets?

MK: O&M best practices start with robust preventative maintenance visits to the sites where the solar assets are located. These site visits are also a great opportunity to look at the solar asset’s design and identify opportunities to increase system performance. Recommended changes might include adding, replacing, or re-locating modules (panels), re-designing string layouts to optimize inverter performance, or replacing outdated or under-performing equipment.

It’s also a best practice to strategically place inventory and equipment close to the site in order to help increase production and reduce costs. Staying on top of new tech advancements for solar equipment and monitoring is key, and that’s why our team at Skyline Energy employs Anvil Crawler as our O&M company of choice.

DR: The solar peak performance season typically starts in May; we start the season by performing site visits to prepare the assets for the peak production period. Our technicians check over 86 points in the system. This includes:

- Testing the performance of the solar modules

- Performing infrared scans on the equipment

- Performing torque checks on connection points

- Reviewing and addressing any issues that we have been made aware of through the monitoring platform

We also use data collected through our monitoring platforms to review performance trends and identify any modules that may have been soiled and require cleaning for maximum performance.

Do O&M practices differ based on the solar asset’s type of location (e.g. farm, office, residence)?

MK: Each type of site comes with its own challenges and benefits when compared with the others.

Residential systems are typically smaller and more expensive to maintain. Residential houses often don’t have much rooftop space available. Solar shingles are an interesting new technology, but for now, their cost is still a barrier to most people. However, there may be a great upcoming opportunity for virtual net metering, where people can purchase energy for their home from a solar asset site in their community.

In terms of commercial real estate, industrial and retail sites are usually well-suited for rooftop solar systems, although some industrial exhausts can cause soiling on the assets. These sites provide easy access for technicians and abundant rooftop space. Skyline Energy believes these types of sites offer good potential to convert to net metering at the expiration of the FIT contract. Office properties, by contrast, can pose challenges: they are usually tall and it can be difficult to access the roof. They may not have as much rooftop space as other types of commercial sites, and therefore a solar asset might not prove very efficient, depending on the size of the building.

DR: We’ve found that agricultural locations tend to have more environmental dust during planting and harvesting seasons, which can result in dirt build-up on the solar assets. Heavy rain will usually wash away a build-up of dust, but on solar assets with a lower slope, the water is not able to run off as effectively, so cleaning may be necessary. However, these locations usually offer easy roof access, and the roofs are typically made of steel so there is no concern about roof replacement.

We also find that sites located near water can become nesting grounds for seagulls, causing excessive soiling on the assets which is difficult and costly to remove.

From an O&M perspective, is there a difference between rooftop and ground-mounted solar assets? Is one more expensive to maintain than the other?

MK: This is another example of both scenarios having pros and cons. In terms of rooftop assets, they are typically better protected than ground-mounted assets, but getting onto the roof and accessing the asset can be challenging. Safety precautions need to be taken to ensure technicians can safely access the systems on a sloped roof, and prevent any damage to the roof.

Plus, there is always the possibility that the landlord might need to replace the roof. In this case, we’d need to take the system off and rebuild it when the new roof is done.

DR: The biggest cost difference to maintain a rooftop system vs a ground-mounted system is that of grounds maintenance. While there is virtually no grounds maintenance involved for a rooftop asset, it is very prevent for ground-mounted systems. If the surrounding grounds are left unmaintained, weeds and bushes can grow in front of the solar modules and cause shade to fall on them, which impacts energy production. Additionally, soil erosion from water run-off can impact the foundation of mounting equipment and frost heave can cause shifting in structures.

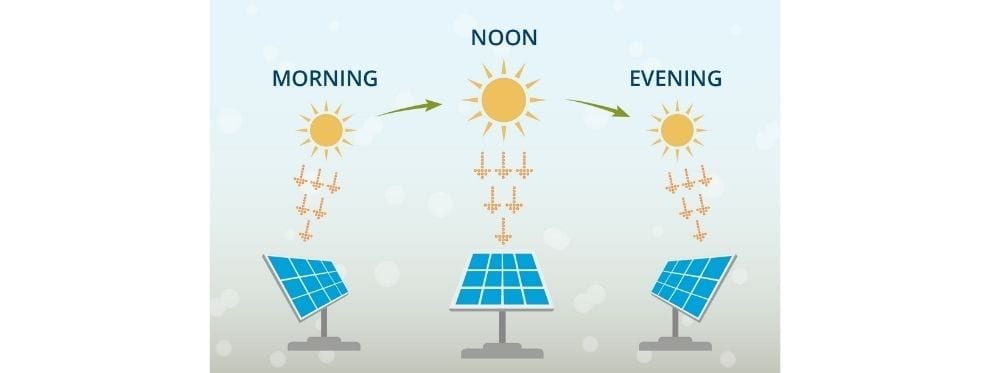

There are special types of solar systems, called single-axis and dual-access trackers, that allow the panels to move throughout the course of the day along with the sun, to gain maximum sunlight exposure. These solar tracking units are typically ground-mounted. The motors and moving parts that need to be maintained have additional costs as well.

Does Canadian weather pose a challenge with solar O&M?

MK: Canada has harsh winters, and snow soiling can cause potential safety issues and under-performance of the assets. In fact, there’s an ongoing debate among solar asset owners on whether the best practice is to clear snow off solar panels or not.

Most of the time, the uncertainty of how long a system will produce until it’s covered in snow again, along with the risk assessment of potential damage to the system (often low risk), means that snow clearing is not worth the expense and effort.

DR: Extreme temperature swings over the course of a year is another unique challenge of managing solar assets in Canada. The transition from excessive cold to extreme heat can cause expansion and contraction of the materials used in manufacturing of solar components. This can cause electrical and mechanical connections to loosen over time.

To prevent this, our technicians perform random spot checks of the module clamps in the system, as well as annual torque checks on the electrical connections throughout the system.

What are some costly O&M procedures that could be prevented with proper maintenance?

MK: The major equipment used for the solar assets managed by Skyline Energy are inverters and modules. Both pieces of equipment are under warranty through the end of the life of the government contracts our solar assets are under. They only require annual maintenance, and if any repair is needed, it’s usually covered under warranty.

Direct current (DC) wire management typically requires much more attention. Loose-hanging wires cause exposure to the elements that can negatively impact the performance of the asset, and also cause damage to other major equipment. We don’t believe in cutting corners for cost savings in any aspect of asset maintenance, but it is especially true in regards to wiring. At site visits, technicians must ensure that wire management is inspected and addressed.

DR: Another common point of failure in a solar system is the inverter, which converts the DC energy produced by the solar panels to alternating current (AC) energy, which is used in the electricity grid system. We find the majority of maintenance costs are related to inverters. Inverter manufacturers provide recommendations for preventative maintenance on their equipment, which most commonly includes performing torque checks on connection points, cleaning fans and filters, and performing visual checks on seals and gaskets to ensure water is not able to enter the equipment. Sometimes infra-red scans are also performed to check for excessive heat in conductor lugs, which can be a sign that the lug is loose and needs to be re-crimped to the conductor.

What are some emerging technologies that are helping to optimize solar systems, and helping to mitigate against maintenance challenges?

MK: For me, the most exciting new technology is bi-facial modules. These modules collect the power of the sun from both sides, which results in the assets’ ability to shed snow faster. The Skyline Energy team is looking forward to evaluating the bi-facial modules’ performance with our snowy winters. We’re also using snow-clearing blowers for ground-mounted assets, which is a relatively new technology as well.

DR: I’m seeing an evolving approach to managing solar assets in general. This new approach involves collecting and analyzing data to perform predictive maintenance. Speaking specifically to Ontario, with its high Feed-In-Tarriff (FIT) rates, the most expensive part of most failures is not the cost of repairing the asset, but the lost revenue as a result of the failure. By collecting data on the conditions around previous failures, we can better predict when a piece of equipment will fail, so we can plan maintenance proactively.

For example, if we know through our predictive maintenance data that a board within a certain brand of inverter has a failure rate of 75% after ten years in service, we can prepare for those failures by proactively having a supply of the boards on hand, to either swap out before failure, or respond immediately upon failure. The goal is to minimize downtime and lost revenue to the greatest possible extent.

Are there any trends that you see companies implementing in their solar operations and maintenance?

MK: When it comes to solar O&M, there’s really no magic ingredient. The recipe for success involves ongoing diligent monitoring, strong performance analytics, quick response times, and a strong team of technicians. The Skyline Energy team takes advantage of new technology as it becomes available, but it will always serve to enhance one of the aspects of our “recipe.”

DR: Back in 2009, the Ontario government launched its Feed-In Tarriff (FIT) Program to encourage the development and use of renewable energy assets, including solar. 12 years later, owners of these systems under older FIT contracts are starting to see their equipment aging and needing more attention, and are considering replacing it with newer, more efficient components. This presents us with an opportunity to also fix any issues in the solar assets’ design that might impact O&M. For example, when we work on DC Repowering (replacing solar panels), we also have an opportunity to improve the system’s wiring, or to relocate equipment so it is more accessible to service technicians.

In our experience solar sites that were originally designed with O&M in mind will perform better, be more cost-efficient to service, and will minimize the need for reactive maintenance. Echoing Matt’s statement, successful O&M means a good balance of monitoring, data collection, timely response, and expertise.

An investment in solar energy assets can be a fantastic first step toward supporting the further development of renewable energy in Canada—with the added potential benefit of a return on investment. The operations and maintenance of the assets should never be overlooked; in fact, it should be thoroughly investigated and be a major factor into investment decisions.

Matt Kennedy

Associate Director, Skyline Energy

Leading the facilitation of all acquisitions and business operations for Skyline Energy, Matt’s in-depth knowledge of asset acquisitions, financial analysis, and valuating clean energy systems is an asset to the Skyline Energy team. He actively lobbies for the adoption of clean energy production in Ontario.

Skyline Energy manages clean energy assets for Skyline Clean Energy Fund, a sustainable investment offered as a private alternative investment product by Skyline Wealth Management.

Dave Raney

Manager of Solar Assets, Anvil Crawler Development Corp.

Dave directs the operations of Anvil Crawler Development Corp’s (Anvil Crawler) Operations and Maintenance (O&M) team. His responsibilities include ensuring the optimization of all solar assets under Anvil Crawler’s service, and creating processes for the efficient and effective monitoring, analysis, and maintenance of these assets.

Anvil Crawler Development Corp. is a clean energy, electrical services, and engineering, procurement, and constructions (EPC) firm based in the Guelph, Ontario area.

About Skyline Clean Energy Fund

Skyline Clean Energy Fund (“SCEF”) is a privately owned and managed portfolio of medium to large scale clean energy assets, focused on acquiring income-producing assets across Canada, under long-term government contracts.

SCEF is offered as an alternative investment product through Skyline Wealth Management Inc. (“Skyline Wealth Management”), the exclusive Exempt Market Dealer (EMD) for SCEF.

SCEF is committed to surfacing value to its investors through asset monitoring and optimization, while providing a sustainable investment product based in clean, renewable energy.

To learn more about SCEF and its asset manager, Skyline Energy, please visit SkylineEnergy.ca.

To learn about additional alternative investment products offered through Skyline Wealth Management, please visit SkylineWealth.ca.

Skyline Clean Energy Fund is operated and managed by Skyline Group of Companies.

For media inquiries, please contact:

Cindy BeverlyVice President, Marketing & Communications

Skyline Group of Companies

5 Douglas Street, Suite 301

Guelph, Ontario N1H 2S8

cbeverly@skylinegrp.ca

More from this category:

The Value of Sustainable Investing

What is sustainable investing? Sustainable investing: it used to be considered a “nice-to-have” for an investment portfolio, but it's quickly gaining ground as a strategy to mitigate portfolio risk and generate returns. It also has the added benefit of making a positive contribution to society. Sustainable investing is an investment in companies that contribute an [...]

Skyline Energy Explains: Biogas, A Natural & Renewable Type of Energy Generation

Like solar, wind, and hydro, biogas is a natural, renewable, and low-carbon alternative to traditional energy generation.

The Sustainable Investment With Solar Experts Behind It

Rob Stein, President, Skyline Energy discusses the history behind Skyline’s clean energy initiatives, and the launch of Skyline Clean Energy Fund.